Unable to Withdraw: What to Do When a Broker Blocks Your Funds

In the world of online trading and cryptocurrency, encountering difficulties when attempting to withdraw your funds can be both frustrating and alarming. Unfortunately, this issue is becoming increasingly common, especially with the rise of scam brokers and unregulated platforms. Investors often find themselves unable to access their money, leaving them wondering what went wrong and what steps they can take to recover their funds. This article explores the red flags to watch out for, why this problem occurs, and how to report a scam broker effectively.

Why Are Withdrawal Issues So Common?

1. Scam Brokers

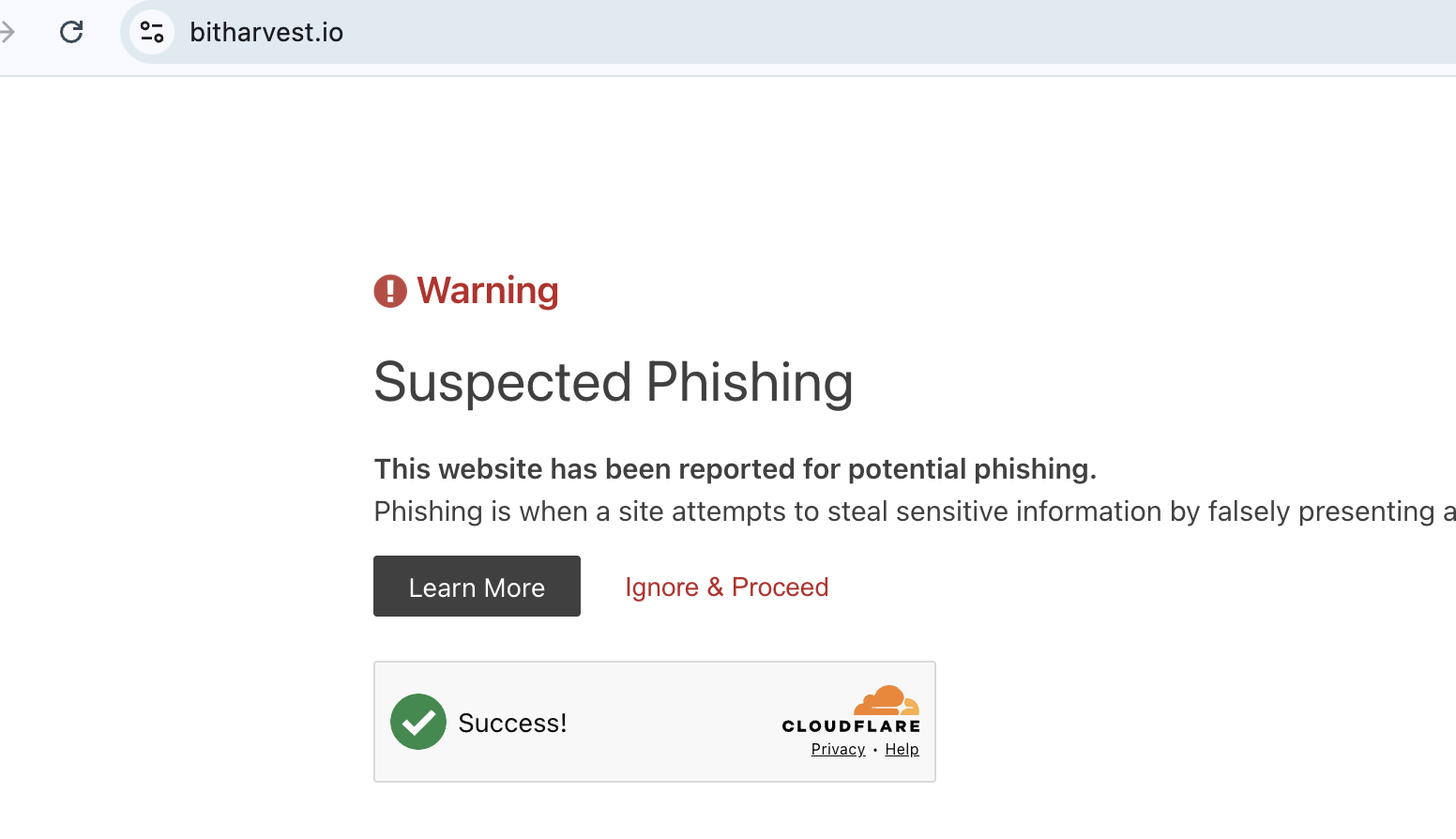

One of the primary reasons investors face withdrawal issues is because they are dealing with scam brokers. These fraudulent entities are designed to look legitimate, often featuring professional websites and making convincing promises of high returns. However, once you deposit your money, these brokers use various tactics to prevent you from withdrawing your funds. Common excuses include technical issues, account verification delays, or additional fees that must be paid before processing the withdrawal.

2. Unregulated Platforms

Another significant red flag is a platform’s lack of regulation. Regulated brokers are required to follow strict guidelines, including fair and transparent withdrawal processes. However, unregulated platforms operate without oversight, making it easy for them to manipulate or block withdrawals without consequences. Investors who trade with unregulated brokers are at a much higher risk of encountering withdrawal issues and losing their money.

3. Manipulative Tactics

Scam brokers often use manipulative tactics to keep your funds tied up. They may suddenly request additional identification documents or impose unexpected fees. Some may even convince you to make further deposits, claiming that it will help unlock your original funds. These tactics are designed to delay the withdrawal process and extract as much money as possible from the victim.

Recognizing the Red Flags

1. Withdrawal Delays and Excuses

One of the first red flags is encountering repeated delays or excuses when attempting to withdraw your funds. A legitimate broker will have a clear and straightforward withdrawal process, with funds typically transferred within a specified timeframe. If a broker continually postpones your withdrawal or cites vague reasons for delays, it’s time to be concerned.

2. Sudden Account Verification Requests

While it’s common for brokers to require account verification before processing withdrawals, scam brokers may exploit this process to delay or block withdrawals. If a broker suddenly requests additional verification after you’ve already submitted the necessary documents, it could be a stalling tactic.

3. Unexpected Fees

Some brokers may introduce unexpected fees just when you’re trying to withdraw your funds. They may claim that these fees are necessary for processing or that they were part of the original agreement. These fees are often designed to extract more money from the victim, with no intention of ever releasing the funds.

What to Do If You Can’t Withdraw Your Funds

1. Gather Evidence

If you find yourself unable to withdraw your funds, the first step is to gather as much evidence as possible. This includes screenshots of your communications with the broker, proof of your deposit, and any withdrawal requests you’ve made. Detailed documentation is crucial if you decide to take legal action or report the scam.

2. Contact the Broker

Before assuming the worst, try to resolve the issue directly with the broker. Send a formal request for the withdrawal and inquire about the reason for the delay. Be sure to keep a record of all communications, as this will be useful if you need to escalate the matter.

3. Report the Scam

If your efforts to withdraw your funds are unsuccessful and you suspect you’re dealing with a scam broker, it’s time to report the scam. You can report the broker to ReportCoinScams, a platform dedicated to exposing fraudulent cryptocurrency and trading platforms. Reporting the scam not only helps protect others from falling victim but also increases the chances of holding the scam broker accountable.

4. Seek Legal Advice

In some cases, seeking legal advice may be necessary, especially if a significant amount of money is involved. A lawyer with experience in financial fraud can guide you on the best course of action, which may include pursuing a chargeback or filing a lawsuit against the broker.

Conclusion

Being unable to withdraw your funds from a broker is a serious issue that should not be ignored. Whether due to dealing with a scam broker, using an unregulated platform, or falling victim to manipulative tactics, it’s essential to recognize the red flags and take swift action. If you encounter withdrawal issues, gather evidence, report the scam broker to ReportCoinScams, and consider seeking legal advice. By being proactive, you can protect yourself and help prevent others from becoming victims of similar scams.

2 comments on “Unable to Withdraw: What to Do When a Broker Blocks Your Funds”